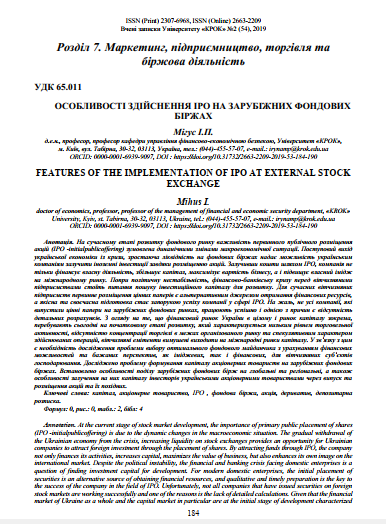

FEATURES OF THE IMPLEMENTATION OF IPO AT EXTERNAL STOCK EXCHANGE

DOI:

https://doi.org/10.31732/2663-2209-2019-53-184-190Keywords:

capital, joint-stock company, IPO, stock exchange, share, derivative, depository receiptAbstract

At the current stage of stock market development, the importance of primary public placement of shares (IPO -initialpublicoffering) is due to the dynamic changes in the macroeconomic situation. The gradual withdrawal of the Ukrainian economy from the crisis, increasing liquidity on stock exchanges provides an opportunity for Ukrainian companies to attract foreign investment through the placement of shares. By attracting funds through IPO, the company not only finances its activities, increases capital, maximizes the value of business, but also enhances its own image on the international market. Despite the political instability, the financial and banking crisis facing domestic enterprises is a question of finding investment capital for development. For modern domestic enterprises, the initial placement of securities is an alternative source of obtaining financial resources, and qualitative and timely preparation is the key to the success of the company in the field of IPO. Unfortunately, not all companies that have issued securities on foreign stock markets are working successfully and one of the reasons is the lack of detailed calculations. Given that the financial market of Ukraine as a whole and the capital market in particular are at the initial stage of development characterized by low trading activity, the lack of concentration of trade within the organized market and the speculative nature of the operations carried out, domestic issuers are forced to enter international markets of capital. In connection with this, there is a need to study the problem of choosing an optimal stock platform, taking into account financial opportunities and desirable prospects for both image and financial, for domestic business entities. The problem of capital formation of joint stock companies on foreign stock exchanges is investigated. The peculiarities of the division of foreign stock exchanges into global and regional ones, as well as the features of attracting investors' capital to Ukrainian joint stock companies through the issue and placement of shares and their derivatives are established.

Downloads

References

Annual report and statistics 2018: World Federation of Еxchange. URL : www.world-exchanges.org

Мігус (Шульга) І. П. Економічна безпека емісійної діяльності акціонерних товариств. Черкаси: Вид-во ТОВ «МАКЛАУТ», 2010. 425 с.

ІРО от «А» до «Я»: справочник эмитента / Под ред. Духненко В.Б. Київ : ООО «РА «Эксперт-Рейтинг». С.38-78.

ІРО на зарубежных рынках. Консультант. - №7. апрель. 2005. С. 54-57.